ATM withdrawal charges to increase from January 1: Here’s all you need to know

By Sanjay Maurya

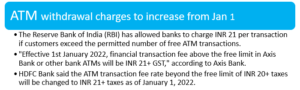

Withdrawals from ATMs beyond a certain limit will put a heavy burden on the pocket of the customer, as banks will begin charging higher fees on ATM transactions on January 1, 2022. If clients surpass the maximum number of free ATM transactions, the Reserve Bank of India (RBI) has enabled banks to charge INR 21 per transaction.

Customers in metros (3 free transactions) and non-metros (5 free transactions) will be able to make limited free transactions (non-financial and/or financial) from other bank ATMs. Customers will be given five free transactions each month from their bank ATMs (financial and/or non-financial). In order to balance the increase in interchange fees and general cost, the central bank has allowed banks to increase the price for cash and non-cash ATM transactions by more than the free monthly allowable maximum.

From next year (2022), the Reserve Bank of India allowed banks to boost charges for cash and non-cash ATM transactions above the free monthly acceptable limit, as announced in June. To compensate for the higher interchange fee and overall cost increase, banks are allowed to boost customer charges to INR 21 per transaction. This rise will go into effect on January 1, 2022, in a circular, the RBI stated. If bank clients surpass their monthly limit of free transactions, they would have to pay INR 21 instead of INR 20 for each transaction starting January 1, 2022.

- Customers in metros (3 free transactions) and non-metros (5 free transactions) will be able to make limited free transactions (non-financial and/or financial) from other bank ATMs.

How to Avoid Paying high ATM Fees

- Use your bank’s app to locate nearby branches and your bank ATMs.

- When paying at grocery shops and other retailers, select the cash-back option.

- Withdraw money in greater amounts but less frequently.

As already mentioned, to counterbalance increasing interchange fees and general cost increases, the central bank has allowed banks to increase the price for cash and non-cash ATM transactions beyond the free monthly acceptable maximum. This rise will go into effect on January 1, 2022, in a circular, the RBI stated. Some banks, such as HDFC Bank and Axis Bank, have already informed their clients about the increasing cost for exceeding the number of free ATM transactions each month.

Must Read:-

- Top 10 pharma companies in the world

- Top 10 company of India 2021

- Top 10 logistic Companies in India 2021

- Top 10 automobile companies in India 2021

- Top 10 fastest growing industries in the world 2021

- Top 10 most charitable person in the world 2021

- Top 10 logistic Companies in India – 2021

- Top 10 Company in the Corporate World

- Top 5 Most Fuel Efficient Car In India

- Start Small and go Big: Low-Investment Business Ideas 2021

- Top 10 Electrical Company in India 2021