PNB hikes charges of these banking services from Jan 15:Details are here

By Sanjay Maurya

The costs for different services given by Punjab National Bank (PNB) have recently been increased, according to the lender. The public-sector lender will raise certain service charges relating to regular banking operations with effect from 15.01.2022.

PNB hikes charges of following banking services

Complete List of all the charge hikes by Punjab National Bank:

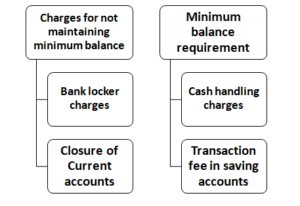

Charges for failing to keep a minimum balance in your account

According to bank website, the quarterly costs for failing to maintain a minimum balance have been increased to INR 400 in rural regions and INR 600 in urban and metro areas.

Charges for bank lockers

PNB has also increased the cost of renting a locker in rural, semi-urban (SU), urban, and metro locations. In metropolitan locations, locker fees have been increased by INR 500.

Minimum balance requirement

The metro region’s non-maintenance of the quarterly average balance (QAB) amount has been raised to INR 10,000. Previously, the threshold limit was set at INR 5,000.

Visit bank locker for free

The number of free visits per year will be decreased to 12 from January 15, 2021; thereafter, a fee of INR 100 per visit will be levied. Previously, the number of free lockers visits each year was limited to 15.

Current account closure

Current accounts that are closed after 14 days must pay fee of INR 800 as a fine. Previously, it was 600. Accounts that are closed after a year will not be charged anything.

Transaction fee in saving accounts

PNB will allow three free transactions per month beginning January 15th, after which a fee of INR 50 per transaction will be imposed (except through alternate channels such as ATM, BNA, and CDM), which will not apply to Senior Citizen accounts. Transaction costs in PNB’s savings and current accounts have also been raised. Regardless of base or non-base branch, the bank is currently allowing 5 free transactions per month, after which a service charge of INR 25 is charged each transaction (except through alternate channels such as BNA, ATM, and CDM).

Cash handling charges

The bank has also reduced the amount of cash that may be deposited in both savings and current accounts. The daily free deposit limit has been reduced to 1 lakh from the previous 2 lakh, and deposits over 1 lakh will be taxed 10 paisa per piece from January 15, 2022, on both base and non-base branches, according to the PNB website

Must Read:-

- Top 10 pharma companies in the world

- Top 10 company of India 2021

- Top 10 logistic Companies in India 2021

- Top 10 automobile companies in India 2021

- Top 10 fastest growing industries in the world 2021

- Top 10 most charitable person in the world 2021

- Top 10 logistic Companies in India – 2021

- Top 10 Company in the Corporate World

- Top 5 Most Fuel Efficient Car In India

- Start Small and go Big: Low-Investment Business Ideas 2021

- Top 10 Electrical Company in India 2021