HDFC Bank Has Increased Its Housing Loan Interest By 10-15 BPS: Full Details

By: Geetanjali

HDFC Bank, one of India’s largest private banks, has increased its housing loan interest rate by 10-15 bps (basis points) reaching an interest rate between 9.05% to 9.8% in the month of March.

HDFC Bank has decided to increase its repo-rate linked home loan interest rate after its merger with HDFC in July, 2023. The current repo-rate is 6.50% which isn’t updated by RBI since April, 2023.

The Bank has mentioned in its website that, “The applicable rate of interest to a customer’s account shall now be linked to EBLR (external benchmark lending rate) instead of RPLR. This is in compliance with the regulatory guidelines on floating rate of interest. On the day of the merger there will be no change in rate of interest (ROI) and any changes in future will be based on EBLR.”

Although the bank has clearly mentioned the new home loan interest rate is applicable to new customers, and is optional for existing customers.

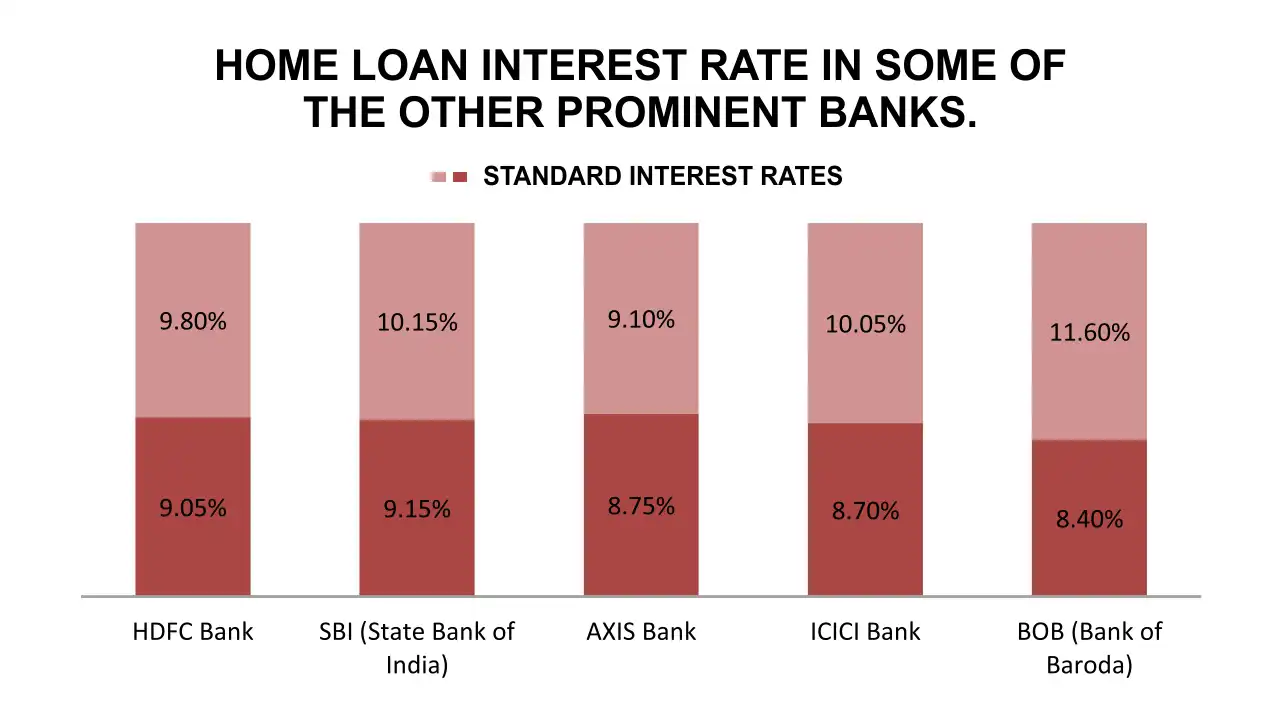

Home Loan interest rate in some of the other prominent banks.

| S.No | Bank Name | Standard Interest Rates |

| 1. | HDFC Bank | 9.05% – 9.80% |

| 2. | SBI (State Bank of India) | 9.15% – 10.15% |

| 3. | AXIS Bank | 8.75% – 9.10% |

| 4. | ICICI Bank | 8.70% – 10.05% |

| 5. | BOB (Bank of Baroda) | 8.40% – 11.60% |

Source: Official websites.

We’ve collected home loan interest rate data of major private and public sector banks in India. Standard Interest Rates in SBI range in between 9.15% to 10.15%, AXIS Bank’s interest rate ranges in between 8.75% to 9.10%, ICICI Bank has a range of standard home loan interest between 8.70% to 10.05%. Among all these major banks BOB (Bank of Baroda) has the highest range between 8.40% to 11.60%.